Featured

- Get link

- X

- Other Apps

3 cryptocurrencies that can hit record prices in July

June was a positive month for the cryptocurrency market, in particular Bitcoin (BTC), which reached a new annual high on June 23.

July can be a very important month for altcoins. Although the Bitcoin (BTCD) dominance rate is rising, there is potential for altcoins to flourish if BTC price consolidates.

This can generate opportunities for traders and investors. With that in mind, we analyzed three cryptocurrencies that could hit new all-time records in July:

Stacks (STX)

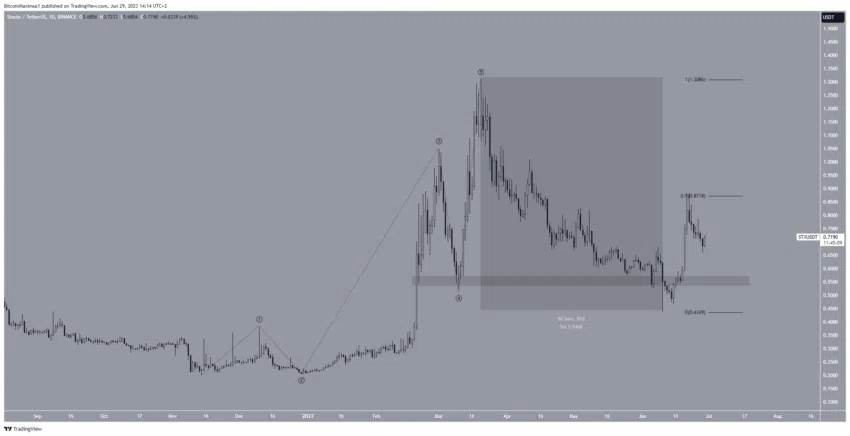

The price of the STX has been rising sharply since the beginning of the year. The movement looks like a full jump of five waves (black). In this case, this would mean that the token initiated a new uptrend reversal.

After reaching a new annual high of $1.31 on March 20, the price went into correction for 82 days, leading to a low of $0.44 on June 10. The asset jumped immediately afterwards, recovering the $0.55 area in the process.

As a result, the previous breakup is considered invalid. Such deviations and recoveries usually lead to upward movements. Therefore, the price of the STX may have started a new five wave move that can take you to the record price of $3.

Despite the bullish outlook, if the price does not exceed Fibonacci’s 0.5 retracement level by $0.87, it could fall to the $0.55 area again.

Injective (INJ)

The INJ has made a significant leap since the beginning of the year. This movement can be compared to a five wave (black) pattern.

Technical analysts use Elliott’s theory to identify recurring long-term patterns and investor psychology, helping them determine the direction of the trend. In this case, the price is currently in the third wave of this movement.

The sub-wave count is given blank, suggesting that the price has just started the fifth and final sub-wave. If the count is accurate, the INJ is expected to complete its third wave near the $14 level, which acts as a horizontal resistance. Although it is below the previous record, it represents the final obstacle before reaching a new historical record.

However, if the price falls below the top of the first subwave (indicated by the red line) at $4.58, this would invalidate the bullish forecast for the INJ. The count suggests a bearish outlook in such a scenario, and the price may fall to $3.0.

Aptos (APT)

The APT is below a downtrend line in the last 154 days. Therefore, the trend is considered to be downtrend until it is broken. In addition, the fall brought the price below the horizontal area of $8, which previously acted as support.

Although the price action so far is bearish, APT is in the process of breaking the line. Since the $8 area is close to the line, a break from the first would likely also cause a recovery of the second.

If the price breaks, the only resistance before the historic high would be at $13.50.

However, if the price fails to make this move, it may fall to the nearest support at $4.0.

- Get link

- X

- Other Apps

Popular Posts

Alpilean not only helps with weight loss. See the other benefits

- Get link

- X

- Other Apps

Researchers use AI to translate texts from 5,000 years ago into forgotten language; and the machine understands better decrees than poems

- Get link

- X

- Other Apps

.jpeg)

.png)

Comments

Post a Comment